As an entrepreneur, understanding and implementing effective tax optimization strategies can significantly impact your business’s profitability and success. By efficiently managing your tax obligations, you can maximize your savings, increase cash flow, and ensure compliance with relevant tax laws. In this article, we will explore various strategies that can help entrepreneurs optimize their taxes.

1. Structure your Business Appropriately

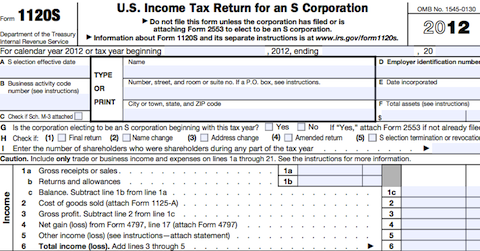

The way you structure your business has a direct impact on your tax liabilities. Choosing the right legal entity, such as a sole proprietorship, partnership, or limited liability company (LLC), can have different tax implications. Consulting with a tax professional or accountant can provide valuable insights into the most tax-efficient structure for your specific business.

2. Take Advantage of Deductible Expenses

Identifying and maximizing deductible expenses is a crucial aspect of tax optimization. Keep detailed records of all business-related expenses, including office rent, supplies, equipment purchases, marketing costs, and travel expenses. By deducting these expenses from your taxable income, you can lower your overall tax liability. It is vital to familiarize yourself with the rules and regulations regarding deductible expenses in your jurisdiction to ensure compliance.

3. Consider Incorporating Overseas

In certain cases, incorporating your business overseas can provide significant tax benefits. Some countries offer more favorable tax rates or exemptions for foreign businesses, allowing you to reduce your tax burden. However, this strategy requires careful consideration and expert advice, as it involves navigating international tax laws and regulations.

4. Leverage Tax Credits and Incentives

Tax credits and incentives offered by governments can help entrepreneurs reduce their tax liabilities. Research and identify any available tax credits or incentives that apply to your business. These can range from research and development (R&D) tax credits to credits for hiring disadvantaged or disabled individuals. Taking advantage of such programs can result in substantial tax savings.

5. Plan for Retirement with Tax-Advantaged Accounts

Contributing to tax-advantaged retirement accounts can serve multiple purposes for entrepreneurs. Besides securing your financial future, putting money into retirement accounts like individual retirement accounts (IRAs) or 401(k) plans can also provide tax benefits. Contributions to these accounts are often tax-deductible, reducing your taxable income in the year of the contribution.

6. Implement an Effective Bookkeeping System

Maintaining accurate and up-to-date financial records is crucial for successful tax optimization. Invest in a reliable bookkeeping system that tracks every transaction, expense, and income. This will make it easier to calculate your tax liability and ensure compliance with tax authorities. Additionally, efficient bookkeeping will help you identify potential deductions, eliminate costly errors, and save time during tax season.

7. Regularly Review and Adjust your Strategy

Tax laws and regulations are constantly evolving. It is essential for entrepreneurs to stay informed and regularly review their tax optimization strategies. Schedule periodic meetings with your tax professional to reassess your approach and identify new opportunities to save on taxes. Keeping abreast of changes ensures that you remain within the bounds of the law while taking full advantage of available tax benefits.

Conclusion

Optimizing taxes is an integral part of running a successful business. By implementing these tax optimization strategies, entrepreneurs can efficiently manage their tax obligations, save money, and improve their financial stability. However, it is important to remember that tax optimization should always be done in compliance with the law and with the guidance of qualified tax professionals. Stay proactive, adapt your strategies as needed, and reap the benefits of a well-optimized tax plan.